888.711.RISK

Equipment Insurance

Cut your premium up to 50% using fleet management technology, with Leif’s exclusive equipment insurance program.

Equipment Insurance: Coverage for owned and rented equipment

Equipment insurance protects your rented or owned equipment in transit, stored offsite, and in operation. It provides broad coverage, including vandalism, misuse, and natural disasters.

Cut your equipment insurance premium with smart technology

Fleet management tools provide insights that unlock exclusive equipment insurance savings by helping you:

- Recover lost or stolen equipment

- Anticipate mechanical issues

- Improve operator safety

These insights reduce claims and earn you discounts.

How fleet management tech strengthens your business

Fleet management tools help your equipment work smarter – and harder.

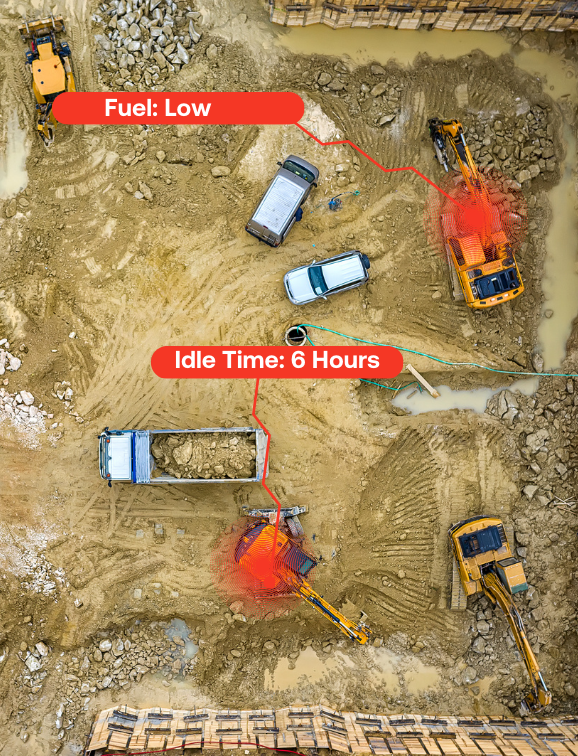

If you’ve ever watched your Amazon package make its way to your doorstep, you’ve used fleet management technology. But this tech is about much more than GPS tracking. It gives you real-time insights like:

- Location

- Speed

- Idle time

- Sudden acceleration and braking

- Fuel level and consumption

- Maintenance issues

- Tipping and rollover

This robust information helps you improve operator behavior, increase efficiency, prevent theft, and reduce downtime.

Safety-focused contractors receive more discounts

Today, we have technology proven to reduce risk. This gives safety-focused contractors an opportunity for better coverage at lower rates. Here’s how we use innovative insurance solutions, AKA: Real-Time Risk Management, to help contractors boost productivity, protect their operations, and win more jobs.

Reduce risk and costs across all lines of insurance

Fleet management technology impacts more than your equipment insurance. Connected assets reduce risk across the board.

Objective dashcam footage of incidentsFewer paid auto claims =

Operator behavior warnings =Fewer commercial insurance claims

Location and usage data = Fewer theft and third-party liability claims

Timely maintenance =Less downtime and loss of use claims

With an improved claims experience and a proven commitment to managing risk, you’re in the best position for the best rates. We’ll help you get them.

Multi-state coverage for contractors of all trades

Leif is actively building the next big cost-saving program for construction insurance. Creatively serving contractors of all shapes and sizes, we offer customized coverage for:

- Artisan Contractors

- Bridge & Infrastructure Contractors

- Concrete Contractors

- Demolition Contractors

- Electrical Contractors

- Excavation Contractors

- General Contractors

- HVAC Contractors

- Landscaping Contractors

- Municipal Contractors

- Oil & Gas Contractors

- Plumbing Contractors

- Street & Road Contractors

- Structural Steel Contractors

- Other specialized trades

Equipment Insurance FAQs

What is fleet management tech and smart equipment?

Smart equipment, or fleet management tech, refers to technology-enabled tools and machinery with built-in sensors, communication, and software. These tools provide real-time monitoring, AI learning, and data analysis. The results: Better decision-making, increased productivity, and a safer job site.

How do connected assets save me money on insurance?

Connectivity with fleet management software and smart equipment provides insights like asset location, operator behavior, and maintenance warnings. This robust information helps you reduce insurance claims and lower your rates over time. In addition, investing in smart equipment shows your insurance carrier you’re committed to reducing risk, which can earn you discounts and position you favorably with your underwriter.

Is fleet management technology complicated to use?

No, you don’t have to be a tech expert to use today’s telematics tools. They’re designed to be easy to use, with built-in dashboards that give you a quick look at the most important information. You can monitor your assets, materials, and people with a few clicks. No IT degree required.

What types of equipment are covered under Leif’s equipment insurance policy?

Our equipment insurance is a broad-ranging policy that covers damaged or missing equipment and tools. This coverage extends to powered equipment like bulldozers and loaders, as well as hand tools like drills and nail guns. It also covers tools in transit. With Leif, you don’t need specialized policies like work trailer or hand tool insurance. It’s all covered under your equipment insurance policy.

How does Leif’s equipment insurance policy compare in terms of cost and coverage to other similar options?

Most contractors find Leif’s equipment insurance policy to be miles ahead of other options on the market. Here are a few key differences:

- Using our technology qualifies you for data-driven discounts up to 50%

- Our policy covers catastrophic exposures

- If your equipment gets stolen with our GPS tracker installed, we’ll waive your deductible

How do I purchase a Leif equipment insurance policy for my owned and rented equipment?

To purchase equipment insurance, jut in touch and we’ll take it from there. Our service promise starts with your first call, text, or chat.

More than an insurance agent:

Our Consultative Approach

As your construction operation grows, your risks compound. Leif’s in-house experts help you create risk and bond strategies tailored to your business.

At Leif, we use a consultative approach to provide ongoing guidance. Our proven five-step process ensures your risk management plan aligns with your goals.

Personalized serviceyou can count on, every time

We deliver exceptional service across all lines of insurance by promising to:

- Identify coverage gaps and quickly secure new policies

- Partner with strong carriers to offer the best program available

- Respond quickly to calls, texts, and chat during business hours

- Offer after-hours claims consultation for 24/7 emergency support

- Deliver most COIs within 2 business hours and bonds overnight

- Create a strategy to maximize your bond capacity for growth

Whether you’re a large multi-state firm, local trade contractor, or something in between – you can hold us to our promise.